Life Insurance for Life Centre Inn ON Safeguarding Your Family's Future With Whitehorse Financial

Life Insurance for Life Centre Inn ON

If something unforeseen happened, would life insurance for life fully protect you and your loved ones?

Life insurance provides a financial safety net, ensuring that family members and loved ones aren’t left struggling to cover expenses when you’re gone. It’s more than just a policy, it’s peace of mind, knowing your loved ones are taken care of no matter what.

Understanding what you need financially and choosing proper coverage is crucial. Life insurance for life Centre Inn ON can handle funeral costs (burial or cremation), debts, income replacement, and help leave a legacy for your family.

With hundreds of plans available from over 35 providers across Canada, including Manulife, Canada Life, Sun Life, Desjardins, Industrial Alliance, Beneva, BMO Insurance, and RBC Insurance, it can be overwhelming to know which policy is best.

We’ll guide you through life insurance types, explain why it matters at every stage, and outline options for seniors and hard-to-insure individuals. By the end, you’ll understand your choices and how to protect your family effectively.

At any time during your read, if you’re interested in getting life insurance quotes, feel free to reach out to us at 905-696-9943.

Essential Insights

- Life insurance helps secure your family's financial future.

- Whitehorse Financial delivers tailored life insurance coverage to meet individual needs.

- Investing in life insurance lessens the financial burden during challenging times.

- Knowing your financial responsibilities is essential when selecting a policy.

- Peace of mind happens when you know your loved ones are financially secure.

Understanding Life Insurance: A Crucial Tool for Financial Security

For more than 300 years, life insurance has protected families, with the earliest policies appearing in 1706.

Simply put, life insurance is a binding contract: you pay scheduled premiums, and the insurer promises a fixed death benefit to your named beneficiaries after your death.

This payout can help cover key expenses like funeral and burial costs, outstanding debts, mortgages, or everyday living needs in Centre Inn ON.

Share:

Send Us a Message

Life Insurance for Life

Have questions about Permanent Life Insurance or Term Life Insurance?

Available Types of Life Insurance Policies

To choose the right coverage for your needs, it’s essential to understand the different types of Life Insurance for Life Centre Inn ON policies. Each policy type provides distinct advantages based on your age, financial goals, and family situation.

Understanding life insurance options is important for strong financial planning. You can choose from two main types: Life Insurance for Life (permanent life insurance) and Life Insurance for a Short Term (term life insurance). Each addresses different needs, helping families stay protected and plan ahead.

Life Insurance for Life

(Permanent Life Insurance)

- Delivers lifetime coverage, not confined to a predetermined term.

- Delivers financial protection for loved ones when unforeseen events occur.

- Ideal for long-term needs, not short-term gaps.

- Assists with funeral expenses and final costs.

- Can be used to leave an inheritance or provide ongoing support for dependents.

Life Insurance for a Short Term (Term Life Insurance)

- Covers a specific term (e.g., 10, 20, or 30 years).

- Ideal for temporary needs, not lifelong protection.

- Helps pay down a mortgage during the coverage period.

- Can replace income in the years you’re raising a family.

- Helps cover debts and obligations during working years.

Why Life Insurance Matters at Every Age

-

Kids (Age 0-18)

Securing Life Insurance for Life (i.e., permanent life insurance) for children provides lifelong protection and can grow cash value over time. Those funds can later help with education, a first home, or starting a business.

Temporary life insurance can handle short-term needs such as tuition or immediate bills, but it ends after the term and won’t offer lifelong security. Deciding between Life Insurance for Life (i.e., permanent life insurance) and temporary coverage comes down to whether you want long-term security or short-term protection.

-

Young Adults (19s-30s)

Even with no dependents yet, early Life Insurance for Life (i.e., permanent life insurance) can secure low rates and support long-term financial stability. Temporary life insurance can cover short-term obligations like student loans, mortgages, or credit card balances.

At age 25, many healthy adults can obtain significant coverage for less than a monthly streaming service. Turning to a life insurance broker or asking for life insurance quotes can help young adults choose the right plan.

-

Start Here

Your choice between Life Insurance for Life Centre Inn ON—permanent coverage—or temporary term insurance depends on your life stage and financial goals. Understanding each policy’s features can guide smart decisions and help ensure your loved ones are protected.

See how coverage needs change at every age—then choose the card that fits you.

-

Parents (30s-60s)

Parents may opt for Life Insurance for Life (i.e., permanent life insurance) to handle long-term needs like final expenses, estate transfers, leaving a legacy for children, or building cash value over time. Funeral expenses include burial or cremation costs.

Temporary coverage (term life insurance) is best for targeted needs like mortgage payments, replacing income while kids are dependent, or paying loans during a defined term.

The death of a primary earner can quickly create hardship—about 40% of families would encounter financial trouble within six months after an unexpected loss. Many families consider combining term life insurance with Life Insurance for Life for maximum protection.

-

Retirees (60+)

As you approach retirement, Life Insurance for Life (i.e., permanent life insurance) is valuable for covering final costs, helping a surviving spouse, and leaving a financial legacy. Cash value whole life and universal policies can even boost retirement income while preserving a guaranteed death benefit.

In Centre Inn, funeral, burial, or cremation costs typically range from $5,000 to $25,000, and extra services can drive the total up quickly. Having Life Insurance for Life ensures your family isn’t stuck with these bills.

Retirees may still use term life insurance for temporary coverage of remaining debts—mortgages or other loans—or to offer a spouse income replacement for a set period.

Life Insurance for Life

Not sure how much coverage you need?

Ask yourself one question: How much money would your loved ones need to maintain their lifestyle and cover expenses if you were no longer here?

How to Choose the Right Policy

Choosing the right life insurance policy means carefully weighing your current finances and future goals. Follow these steps to figure out the coverage that fits your needs best.

How much might a basic funeral, burial, or cremation run? Estimated range: $5,000–$25,000.

Suggested Option: Life Insurance for life time coverage (Permanent Life Insurance)

Are transportation, catering, memorial services, flowers, headstones, obituary notices, and admin fees part of the costs? Approximate range: $3,000–$30,000.

Suggested Type of Life Insurance: Life Insurance for life time coverage (Affordable life insurance for seniors)

Do I currently owe on a mortgage, car loan, credit cards, or other debts? (Average mortgage in Canada: $300,000; car loan: $25,000; credit card debt: $4,000.)

Suggested Life Insurance Type: Term life insurance

Will my family need income support without me? Typically, income replacement is calculated by taking your annual income and multiplying it by 5–10 years, depending on family needs and future obligations ($100,000–$250,000).

Suggested Type of Life Insurance: Over 50 life insurance, life insurance for elderly people, Term life insurance, Permanent Life Insurance.

Do I intend to leave funds for my children’s school or university? University tuition can range from $6,000–$15,000 per year for each child. Life insurance for seniors over 65 may help with estate planning that benefits grandchildren’s education.

Suggested Type of Life Insurance: Term life insurance, Permanent Life Insurance

Do I plan to leave money to charity, family, or future generations? Amounts often vary widely—commonly $5,000–$50,000 or more. Life insurance for elderly people or old-age life insurance can be structured to help with charitable giving or a family inheritance.

Suggested Type of Life Insurance: Term life insurance, Permanent Life Insurance.

Life Insurance for Life

Life Insurance for Life from $30/Month

These estimates are meant to guide your planning. We’ll tailor the right solution to your needs with Life Insurance for Life (permanent life insurance). Reach out today to get your personalized life insurance quotes.

Why Life Insurance Is Needed by Older Adults

A lot of people believe life insurance is only needed while raising a family or paying off a mortgage. However, for older adults, life insurance can still be key to protecting loved ones and reducing financial stress.

Important Reasons to Consider Life Insurance at 60+

A smaller policy can provide children or grandchildren a meaningful gift, aiding with education, debts, or long-term goals.

If pensions, benefits, or other income fall after a partner’s passing, life insurance for life can help the surviving spouse keep financial stability.

You may still have medical bills or debts outstanding. A life insurance payout provides the cash to pay them immediately.

Covering outstanding debts or remaining mortgage balances helps protect heirs from financial strain.

Life Insurance for Life Centre Inn ON can deliver extra funds if savings or pensions are insufficient, ensuring your loved ones are financially secure

More than anything else, life insurance provides reassurance—so loved ones don’t struggle financially when times are tough.

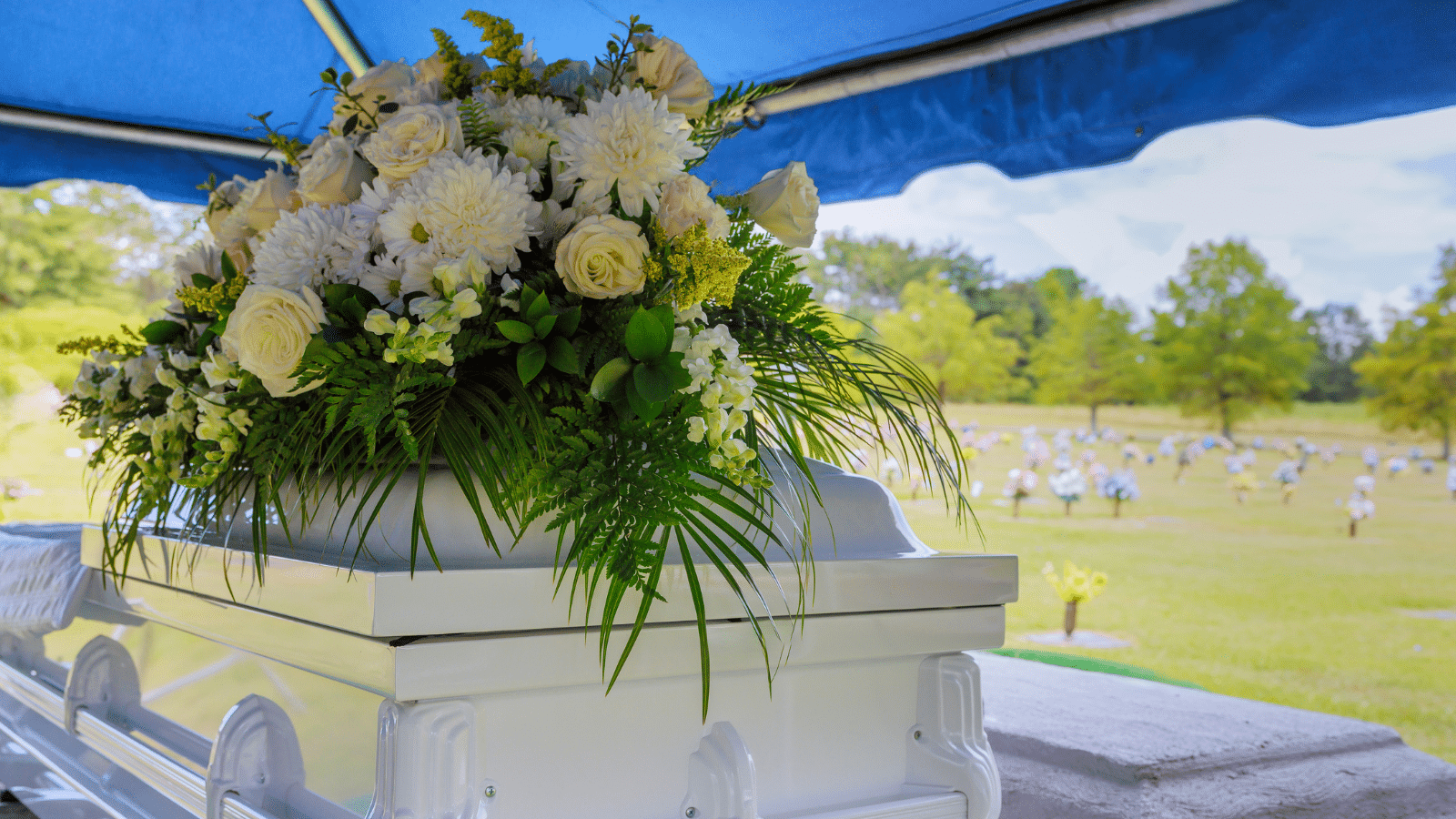

This is the usual driver. Even though life insurance has many benefits for older adults, covering final expenses is most common. In Centre Inn, funeral and burial often run $5,000 to $25,000 or more. Life insurance for life helps prevent these costs from becoming a sudden burden on your family, giving peace of mind in tough times.

your trusted local Life Insurance for Life Advisor Now.

As people age, getting life insurance for elderly people—including life insurance for seniors over 65—can be harder because of health risks and pre-existing conditions. Older adults are more likely to have medical issues that make standard policies tougher to qualify for or more costly.

Life insurance for old people is often treated as a special category because most individuals 60+ are on a fixed or minimum income from pensions and savings. Life insurance old age means affordability and stability matter most. It’s important to ask your life insurance broker about options that fit your budget and long-term needs, especially for those in this age group. For example, some people may find that a smaller permanent policy works well if their main concern is funeral expenses. Others might feel that a short-term plan is a better fit when the goal is to provide higher coverage, such as for spousal income, while keeping premiums more affordable.

If someone ends up with a policy that’s too costly, they might not be able to keep it over time. When a policy is canceled, its benefits are gone, leaving loved ones unprotected. The right plan should deliver peace of mind and be sustainable for the future. When reviewing cheap life insurance for older people, compare choices closely to find coverage that balances price with needed protection.

At WhiteHorse Financial, we’re dedicated to life insurance for elderly people and life insurance for seniors over 65, with tailored options that help seniors find affordable coverage. Our experience offers peace of mind, helping seniors protect themselves and loved ones when typical choices are limited.

Life insurance for 70 and over: Cheap life insurance for seniors

Many Canadians are surprised that a Life Insurance for Life policy over 70 is still a possibility. Did you know that nearly 1 in 3 seniors take out a policy to cover final expenses? Or that some plans don’t require a medical exam at all? Cheap life insurance for elderly can provide peace of mind, ease the financial burden on loved ones, and even leave a small legacy—without stretching a fixed pension income. It’s worth exploring options that fit your budget and long-term goals.

Life Insurance for Hard-to-Insure Clients: Explore Your Options

Your health—past or present—doesn’t have to prevent you from getting life insurance—that’s WhiteHorse Financial’s promise.

Because of age or health factors, many people find it challenging to get life insurance that fits.

Diabetes, heart concerns, cancer, respiratory problems, kidney disease, and autoimmune conditions can make standard life insurance harder to qualify for; from 50–80, new issues—high blood pressure, high cholesterol, or diabetes—may arise and lead to serious health issues.

Even with these challenges, we offer customized options that provide coverage for clients facing these conditions. From guaranteed issue to simplified issue and specialized plans for older adults, we work so people in Centre Inn get the protection they need.

Life Insurance for Life Centre Inn ON can cover final expenses and funeral costs, providing peace of mind for families.

Life Insurance for Life

Looking for the best

life insurance quote?

Affordable Life Insurance for Seniors: Cover Funeral Costs with Confidence (Up to $100,000 in coverage)

For many seniors, the main goal of life insurance for life is covering funeral and final expenses. Studies indicate that many Canadians—roughly one in three—use an insurance policy to help pay funeral bills, reflecting how often seniors plan to lessen family costs. Beyond funeral bills, seniors also use coverage to leave a modest inheritance, support a spouse, pay off debts, or donate to causes. In this sense, life insurance for life provides peace of mind by meeting multiple financial needs.

In many situations, the primary purpose of life insurance for elderly people is to offer financial support for funeral expenses, so loved ones aren’t left with surprise bills.

In Centre Inn, a typical funeral costs about $5,000 to $25,000, making the case for planning in advance.

Final expense insurance—also called Funeral Expense Insurance (aka Burial Insurance or Cremation Insurance)—helps cover funeral costs (Burial or Cremation) for loved ones. It’s important to understand these costs to protect your family.

As you plan a funeral in Centre Inn, families usually consider multiple options to honor their loved ones. Here are a few of the most common:

Cremation remains the preferred option in Centre Inn ON. It provides flexibility and is typically cheaper than traditional burial. Expect direct cremation to average $1,000 to $3,000, while full-service cremation—including a memorial—runs about $2,500 to $7,000.

Traditional burial typically requires embalming, a casket, a cemetery plot, and a funeral service. Many select it for cultural, religious, or personal reasons. The cost usually runs $10,000 to $25,000, varying by location and the services provided.

Natural burial is a greener choice that avoids embalming and uses biodegradable materials. It allows the body to return to the earth through natural decomposition. In Centre Inn, certified green burial grounds provide families with environmentally conscious options.

Water cremation, also known as aquamation, is an environmentally friendly alternative to traditional cremation. It uses water and alkali to gently return the body to its natural state. This process is legal in Centre Inn and is available at select funeral homes.

A celebration of life is a personalized, informal gathering that honors the deceased’s life and accomplishments. These events can take place in parks, community centers, or private homes and often mirror the individual’s personality and preferences.

In Centre Inn ON, the two leading funeral choices are cremation and traditional burial.

Cremation is often selected for affordability and flexibility, giving families control over how and when memorial services take place. Traditional burial remains popular for cultural, religious, or personal reasons, offering a formal, long-standing way to pay respects.

Cremation: An Affordable Alternative to Traditional Burial

In Canada, cremation is widely preferred because it’s both flexible and more affordable than a traditional burial. It lets families decide when and how to hold a memorial or celebration of life, enabling a meaningful tribute without the logistical demands of a full burial.

Seniors frequently plan for cremation, and life insurance for elderly people can help ensure funeral and cremation costs are paid.

Adults 70 and older often seek life insurance that covers cremation, since these plans are typically more affordable and easier to qualify for.

Cremation typically involves the respectful handling of the body, the cremation process itself, and arrangements for the ashes, which can be kept in an urn, scattered in a meaningful location, or interred at a cemetery. Families can also choose to include a memorial service, either before or after the cremation, to honour the deceased.

To handle expenses, many seniors go with cremation insurance. These policies are intended to cover cremation expenses and related services, easing the burden on families. A top advantage is cost—plans can start at $1 per day, giving older adults an affordable way to plan ahead with peace of mind.

Traditional Burial: Honouring Loved Ones with a Lasting Tribute

Traditional burial remains a popular choice for many families in Centre Inn, often selected for cultural, religious, or personal reasons. It provides a formal and long-standing way to honour a loved one, with a cemetery plot, casket, and funeral service that allows family and friends to come together to pay their respects.

A typical burial involves embalming, preparing the body, selecting a casket, and arranging a gravesite. Families can also include a full funeral service, complete with rituals, eulogies, and memorial gatherings, making it a meaningful and structured way to celebrate the life of the deceased.

If costs are a concern, burial insurance can offset the price of a traditional funeral for seniors. As with cremation insurance, these policies help ensure family isn’t left with unexpected expenses. Flexible, budget-minded options provide peace of mind that final wishes will be fulfilled.

Why Choose Life Insurance for Life Centre Inn ON to Cover Funeral Expenses?

A major advantage of selecting Life Insurance for Life Centre Inn ON to handle funeral expenses is its flexibility—there’s no need to make an immediate burial-versus-cremation decision. By securing the funds beforehand, your family can focus on honoring your wishes instead of finances. It’s often more affordable than paying a funeral home directly, and the full payout goes to the beneficiary, leaving any leftover amount with the family.

Beyond flexibility and savings, life insurance for funeral expenses delivers peace of mind by making sure loved ones aren’t stuck with surprise bills during a hard time. It can cover extras like flowers, memorial services, transportation, and legal fees. Some policies also extend to outstanding debts or smaller expenses, providing broad financial protection. By planning ahead with life insurance, seniors can leave a lasting legacy and ease both the financial and emotional load on family.

How Final Expense Insurance Works

Final Expense Insurance (AKA Funeral Expense Insurance, Burial Insurance, Cremation Insurance) is a type of life insurance that provides a lump-sum payout to your designated beneficiary after your passing.

Who is eligible to be a Final Expense Insurance beneficiary?

Here are common beneficiary options:

- Immediate family members – such as a spouse, children, or parents

- Extended family (siblings, nieces, nephews, or grandchildren)

- Close friends – someone you trust to handle your final expenses

- Trusts and charitable groups — for legacy gifts or cause support

- Funeral homes — proceeds can be directed to pay for burial, cremation, and related services

Naming a beneficiary ensures your final wishes are honored and the funds are used as you intended.

Securing Your Family's Future Starts Today

Life Insurance for Life Centre Inn ON is more than just a financial product—it’s a promise to your loved ones that they’ll be protected, no matter what tomorrow brings. At Whitehorse Financial, we believe that everyone deserves the peace of mind that comes with knowing their family’s future is secure.

The right life insurance policy adjusts as your life changes. Whether you’re starting out, raising a family, or preparing for retirement, it’s a great time to review coverage and make sure it fits your situation and future goals.

There are plenty of life insurance options, each crafted for different needs. Beyond coverage, it’s about creating a lasting legacy for your family.

With Whitehorse Financial, you’ll have a team to guide your decision. We help ensure your choices support your family’s financial goals.

Reach out to start securing your future. We offer personalized insurance solutions in Centre Inn ON that suit your needs. Your family’s well-being is our top priority.

Contact us today at (905) 696-9943 or via email at info@thewhf.com. Let’s work together to protect your loved ones.

Frequently Asked Questions About Life Insurance for life

Still have any questions? Contact our Team via info@thewhf.com

Can I have multiple life insurance policies? Or Can I have multiple Funeral Expense Insurance policies?

Yes—you can have multiple life insurance and funeral expense insurance policies from different providers. This approach, known as “laddering,” lets you tailor coverage to different needs and time frames. For instance, you might carry a 30-year term for the mortgage and a 20-year term for children’s education.

How frequently should I review my Life Insurance for Life Centre Inn ON coverage?

We recommend an annual review of your Life Insurance for Life Centre Inn ON coverage, plus a check after big life events like marriage, the birth of a child, buying a home, or a significant career change. These regular reviews help keep your coverage in step with your changing financial needs and family situation.

Are life insurance payouts taxable in Canada?

Generally, life insurance death benefits in Canada aren’t taxed when they go to a named beneficiary. However, exceptions exist (for example, corporate-owned policies), so consider consulting a financial advisor.

Can older adults qualify for life insurance without a medical exam?

Yes—simplified issue and final expense life insurance frequently require no medical exam. They’re ideal for seniors or individuals with health challenges who want guaranteed coverage without delay.

How can I make sure my beneficiary gets the payout promptly?

Properly naming beneficiaries, keeping contact information updated, and submitting necessary documents ensures your beneficiaries can access the funds without delay. WhiteHorse Financial provides guidance to streamline this process.

I’m past 80—can I still obtain life insurance coverage?

Yes—at WhiteHorse Financial, we work with several insurance providers so seniors can still get coverage after turning 80. With the right provider, you may secure a policy offering protection up to age 85. That means peace of mind and help with final expenses without burdening your loved ones.